|

PageBox |

| Support | Map |

|

|

|

|

|

|

|

|

Patent search - issues

| Table of content | |

|

In an Empirical Look at Software Patents Bessen and Hunt cite an IBM attorney: "[The patent standard] currently being applied in the U.S. invites the patenting of ideas that may have been visualized as desirable but have no foundation in terms of the research or development that may be required to enable their implementation." Here there are two observations easy to verify. The first one is that the patent purpose is to protect the function rather than the means. The second one is that inventors do not provide detailed instructions explaining how the invention works.

The second observation has serious implications. Patents were invented (1) to provide an incentive for inventing (2) to not lose knowledge. Before the introduction of patents inventors kept their inventions secret. As a consequence after one or two generation the invention was lost. Countries grant inventors "the right to exclude others from making, using, offering for sale, or selling" inventions in compensation of the invention disclosure. An invention whose description does not allow a person of the art to make the same product breaks this contract. Furthermore

either the way to implement the invention is obvious, in which case either the invention itself is obvious, and hence not patentable or it is a Columbus egg; and is it possible to grant patents for Columbus eggs when there are one million specialists in any domain sufficiently important to motivate a patent filing and when disclosures are easy and cheap thank to the Web, the forums and the mailing lists? every Columbus egg has been invented (for instance at coffee break) and disclosed independently many times; this is just a matter of luck and effort for an alleged infringer to find a prior disclosure of a Columbus egg;

or the description must contain enough details to allow reproducing the invention, otherwise the public has no evidence that the inventor owns the claimed invention.

Poor description not only breaks the patent contract. It infringes the patent law as well. We found in the Guidelines to Inventorship Determination of the McGill University this explanation: "Conception of an invention occurs when a definite and permanent idea of an operative invention, including every feature of the subject matter sought to be patented, is determined. Conception is complete when one of ordinary skill in the art could construct and work the invention as described and claimed without unduly extensive research or experimentation. The point in time when the invention, as defined by the claims, is conceived is when the inventor can describe the invention with its specificity, not when it is just a goal or research plan hoped for, or to be obtained hypothetically. In other words, an invention is complete and operative if the inventor is able to make a disclosure which would enable a person with ordinary skill in the art to construct or use the invention without extensive research or experimentation" [quoted in the document]. This is Canadian law but applies with some nuances elsewhere.

Examiners and courts hesitate to reject or invalidate software patents on the ground that their descriptions do not allow persons of the art to implement them:

A software patent is a "cheap patent" whose patentee did not make extensive research or experimentation. Therefore even without any description a person of the art can implement the invention without extensive research or experimentation.

In USA Bessen and Hunt found that "For software patents and business methods, the courts have largely eliminated this [enablement] requirement (Burk, 2002, Burk and Lemley, 2003 forthcoming)."

Enforcing a better enablement would not necessarily improve the quality of software patents.

It is possible to describe in great detail a process even if it is not innovative. The only benefit is that "inventors" should wait up to the end of the project to patent whereas today "inventors" should patent as soon as they completed the specification to get the earliest filing date.

A better enablement would increase the cost of writing a patent but this cost would remain marginal in the project cost. The software patent would remain a cheap patent.

Furthermore poor descriptions are usually not the consequence of a deliberate effort for seeking protection and at the same time keeping methods and processes secret. They are more often the consequence of lack of care.

When you browse patent databases you find evidences that the description section is not worse than the rest of a software patent. There are two types of claims: independent claims and dependent claims that refer to another claim. However we found claims referring to themselves (meaningless - they were not recursive!) We also found patents whose description did not allow a person of the art to make the same product but that described the patentee IT system (a gift for competitors). Patents are great examples of the interfacing problems described in Society and computing. A software patent requires the cooperation of three populations:

Management who has the power but lacks skills and control means for the patenting process

Programmers who have incentive to describe "inventions" but not for helping lawyers

Lawyers whose objective is to keep under control the time spent on a patent

The wording and content of a software patent is a not really a concern for a company. A company is actually interested by another sort of quality that we could call unavoidable-ness. An unavoidable patent is a patent that other companies must license or that prevents competitors of offering the similar product. Unavoidable-ness depends on the width and location of the claim scope that cannot be easily measured. A patent that can be easily avoided is just a waste of time and money. Even a portfolio patent must prejudice competitor’s interests to be useful in cross-licensing bargaining.

The only reliable way to measure the unavoidable-ness of a patent is to count the patents that refer to this patent. This is almost the same principle as the page popularity computed by Web search engines. This method is well described in Quantitative Methods of Research Evaluation Used by the U.S. Federal Government: "When a U.S. patent is granted it typically contains seven or eight references cited-U.S. patents on its front page. These references link the just issued patent to the earlier cited prior art, and limit the claims of the just issued patent. They point out where essential and related art already exists and therefore limit (are cited against) the claims of the citing patent. In one important respect patent citations differ from citations in a scientific paper. Front-page patent references are either put there by the examiner, or suggested by the applicant and his attorney and approved by the patent examiner, who is an expert in the art which he is examining. The net result of this is that a patent citation is undoubtedly stronger and more likely to be relevant to the subject area of the patent than a literature citation."

As we can see patent references are more reliable than paper citations and Web page links. However there are regional differences: "In the US, the applicant supplies a list of prior art references with their application, whereas in Europe the applicant is not required to do this and all prior art searching is done by patent office staff. Thus, front-page reference lists on U.S. patents benefit from contributions from applicants aware of the full technological context whereas in Europe, front-page reference lists are constructed by patent office staff naturally focused on the patent system."

"In the US, these procedural differences are reinforced by strong incentives. The U.S. rule of disclosure requires the applicant to disclose all known prior art references, and failure to do so is considered fraud on the patent office and can provide grounds to disallow the patent. Incentives to reference are strengthened in the U.S. in comparison to Europe by the heightened risk of patent litigation. The examiner is presumed to have examined a referenced document and to have decided that the invention was novel in relation to what was reported in the document. Therefore, a document referenced on a patent is much more difficult to use in court as evidence that the patent is invalid because the invention was not novel."

You can find this explanation on the USPTO site: "The U.S. Patent and Trademark Office cannot be aware of all PRIOR ART in a particular field of technology at the time a PATENT application is filed in that field. Therefore, the patent applicant is required to file an Information Disclosure Statement when the PATENT APPLICATION is filed, or shortly thereafter, that discloses the prior art that is most relevant to the CLAIMed INVENTION. The inventor is more likely to know the prior art in the field of invention than the PTO so the burden is on the inventor to educate the PTO about the prior art. Failure to comply with this requirement can invalidate any patent that issues on the grounds that the inventor committed a fraud on the PTO by not disclosing prior art of which the inventor was aware."

CHI Research wrote "Our investigation reveals a link between the technological strength of companies, measured quantitatively using patent citation analysis, and their subsequent stock market performance. The more high-impact patents that a company owns - i.e. patents that build on the latest technologies, are highly cited, and link extensively to scientific research - the greater its average share price increase." CHI Research even issued U.S. Patent No. 6,175,824 "Method and Apparatus for Choosing a Stock Portfolio, Based on Patent Indicators."

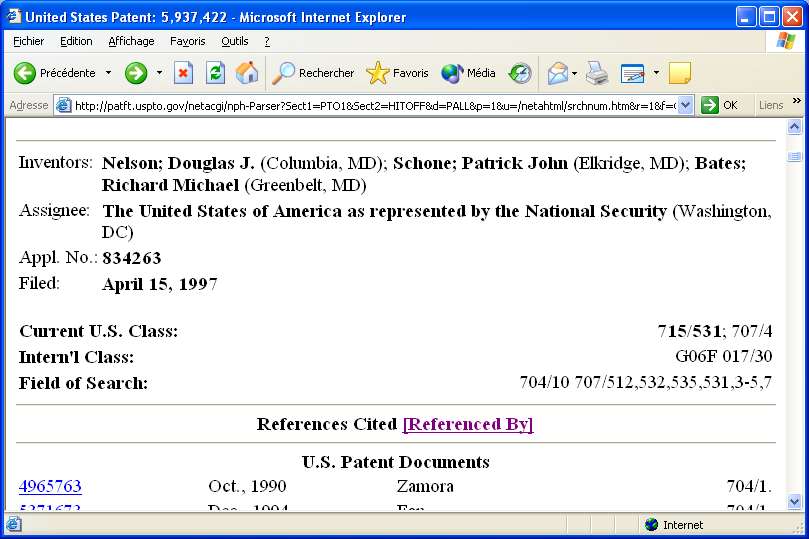

On USPTO to display the patents that refer to a patent click on the Referenced By link on the patent page:

In the case of the NSA patent 5,937,422, which was one of the most read and commented patents you find 17 patents six years and a half after the date it was filed. 17 is a good figure. Most patents are not referenced at all.

We are not convinced that the CHI Research method is effective for choosing a stock in software industry because

This method measures the performance of a company five years ago

To convince the analysts a company must be able to show that it issued a sustained level of high-impact patents on much more than five years. Maybe only IBM is in this case.

Counting patent references is not a better metric for management:

Maybe 95% of the software patents are not referenced. Few patents are referenced more than twenty times. From a statistical point of view how significant it is to have one reference instead of zero?

A patent can be referenced by an applicant only when it is visible. In software industry we observe invention bursts when a new technology enables doing new things. These invention bursts are not longer than the secrecy period of patents (the time between the patent application and publication).

How useful is it to know that the company did well or was granted no patent five years ago?

A company able to issue unavoidable patents certainly has a brilliant future. But this certainly requires a good deal of commitment, honesty and mutual trust. We explain in Society and Computing why such things can only happen by chance. If the programmer gets a fixed bonus per invention regardless of its virtues why should she confess that the thing she was working on did not give the expected result or is impractical? Why should she go beyond her assignment and overwork to really innovate when she knows that her efforts will not even be noticed? In the same way why the lawyer should try patenting with broad scope claims when she knows that broader claims increases the potential difficulties with examiners, the risk of opposition and claim invalidation for a patent that the customer will never read afterwards?

At this stage it is interesting to take a look at the University practice.

To look at the patent policies of Universities, search on Google with "university", "patent" and "policy" keywords. Though some Universities may be more generous than others these principles apply:

All patentable inventions conceived or first reduced to practice by University members in the conduct of University Research shall belong to the University. On the other hand labor law says that inventions made by individuals on their own time and without the use of University resources shall belong to the individual inventor.

In some Universities an expiration clause is defined. In cases in which the University has an ownership interest in an invention and either does not file a patent application within one year, or fails to make a positive determination regarding pursuit of a patent within a period of six months from the date of disclosure, all of the University's rights shall be reassigned to the inventor.

A University does not necessarily patent even when the invention is found to be patentable and useful and to have a commercial interest. A University typically seeks a licensee first before filing a patent application.

In the case of a patent owned by the University the inventor receives between 25% and 50% of the net royalties of the invention. Net royalties are gross royalties less expenses resulting from patenting and licensing the invention.

Universities define the following roles:

Inventors

Resources

Licensing officer

Marketing responsible for finding licensees

The inventor uses resources to reduce the invention to practice; the licensing officer addresses the legal aspects; marketing assesses the commercial potential and seeks licensees. The actual practice is somewhat different but at least there is an invention framework and inventors have an interest at inventing something with a commercial interest. Universities can patent inventions whose process or method is useful or unavoidable. The application of these principles to software patents in Industry is however not easy:

A University looks for licensees. Its job is not to implement and sell. A company looks for a temporary monopole. Its job is to implement and sell.

A University looks for royalties. A company wants to exploit its invention. For a company, revenues from settlements, court decisions in infringement disputes and royalties are only a compensation for lost exploitation revenues.

We showed in Society and computing that because software has a zero marginal cost a patent has a deterring effect. There are even anecdotal evidences that this effect is partly irrational. Today licensing a software process or method is usually not considered as an option. Therefore there are no customers for licenses.

Therefore even if the company put in place the same kind of compensation scheme as Universities the inventor will receive a fair share of the invention exploitation. However we believe that the interest of software companies is to put such schemes in place. The inventor commitment is the key factor for patent usefulness and unavoidable-ness.

"Software patents shifted from being relatively expensive during the early 80s to being relatively cheap during the late 90s." but the cause is a mentality change. Companies that felt exposed to lawsuits patented to reduce their exposure, which is consistent with another Bessen and Hunt observation " It appears that most software patents are acquired by firms in industries that accumulate large patent portfolios."

Accumulation of patent portfolios did not start with software patents. This may even be a legacy of Edison, who first designed a company for inventing. There are evidences that before WWI patents were already "understood to have important uses outside the protection of technology that the firm planned. In particular, they were an important strategic weapon in the long term struggle between a large firm and its equally large, equally well heeled rivals." [Found in One Hundred Years of solicitude: Intellectual Property law, 1900-2000 by Robert P. Merges; itself referring to Leonard Reich]. Quite interestingly one of the pioneers of patent portfolio accumulation was General Electric (a merger of Edison General Electric Company and Thomson-Houston Electric Company in 1892). You can find on the General Electric site: "By 1890, Edison had organized his various businesses into the Edison General Electric Company. The Thomson-Houston Company and the various companies that had merged to form it were led by Charles A. Coffin, a former shoe manufacturer from Lynn, Massachusetts. These mergers with competitors and the patent rights owned by each company put them into a dominant position in the electrical industry. As businesses expanded, it had become increasingly difficult for either company to produce complete electrical installations relying solely on their own technology. In 1892, these two major companies combined to form the General Electric Company."

At the beginning of the twentieth century the Society was more intellectual-property driven than now. Thomson-Houston and Edison were neither looking for economies of scale, nor buying brands or market shares. The merger was the solution to a deadly embrace problem. This was a serious issue: the dispute between Wright brothers and Curtis almost killed the American aircraft industry at the very time this industry had a tremendous development in Europe thank to WWI. The declining importance of Intellectual property after WWI may have been caused by the permanent war state up to 1989:

Governments were omnipotent

As far as defence was concerned the Intellectual property did not apply

Innovation was primarily the consequence of military research that gave us aircrafts, electronics, computers and even Internet

Cooperation was a kind of patriotic duty

Since 1989 the World is again in peace but things changed since 1914. When Edison used patents to conquer the electrical industry today large firms issue patents to secure their market position. Software patenting is more defensive than offensive. Bessen and Hunt note: "Overall, software patents are more likely to be obtained by larger firms, established firms, U.S. firms, and firms in manufacturing (and IBM); they are less likely to be obtained by individuals, small firms, newly public firms, foreign firms, and software publishers." Bessen and Hunt found that: "The manufacturing sector acquires 69% of software patents, but employs only 10% of programmers and analysts; software publishing and services (including IBM) acquires only 16% of software patents, but employs 42% of programmers and analysts." They also found that software publishing acquire 6% of software patents, other software service firms, excluding IBM acquire 2% of software patents.

IBM is the giant of Intellectual Property and not only for software patents. IBM received 3,288 U.S. patents from the USPTO in 2002 and 3,415 in 2003. Over 1,250 of these patents were software patents of a quality above the average.

Patent accumulation used to be a weapon in the long-term struggle between a large firm and its equally large, equally well-heeled rivals. In the software industry there is no economy of scale and the rival of a corporation can be a short-lived small company. Furthermore the Economy is global. Software patents cannot be credible as an offensive weapon in a context where:

identifying infringing companies is costly,

suing a smaller company, especially in another country may damage the firm brand,

other large firms also have a large number of patents, which creates a situation of mutual infringement.

The software patent space is filled in two ways:

Horizontally by IBM and other software publishers for core technology patents

Vertically by market leaders for market-specific applications of computing. Profitable markets dominated by large companies have a high patent density. Less profitable markets in which companies are smaller may be almost patent-free.

On markets with a high patent density patent wars and Intellectual Property-driven mergers could happen in the same way as at the beginning of twentieth century. This would maybe have already happened if market leaders had been able to file good quality patents and to enforce them effectively.

For core technology patents wars and mergers are unlikely to occur.

First core Software patents are profitable for patentees only in two scenarios:

Strong patent owner against strong patent owner. In this case patents secure market shares and limit competition between large firms that sign transactions and cross license their patents.

Weak patent owner against strong patent owner. In this case a patent can be an extremely profitable investment because the strong patent owner must either pay license fees as illustrated by 5,838,906 (Eolas) or buy the weaker company.

Today the other scenarios are not profitable. A weak patent owner cannot make money at identifying small infringers and seeking settlements or suing them at we have seen with PanIP. A strong patent owner cannot easily ask license fees to small companies without hitting the headlines and facing serious problems. The Unisys story with the LZW compression method (patent 4,558,302 on USPTO; if you do not remember read this reminder) illustrates this issue.

Second customers are primarily concerned by switching costs:

They prefer solutions based on royalty-free based standards

They use patented solutions only if the solution is implemented in a perennial product with a good value for the price.

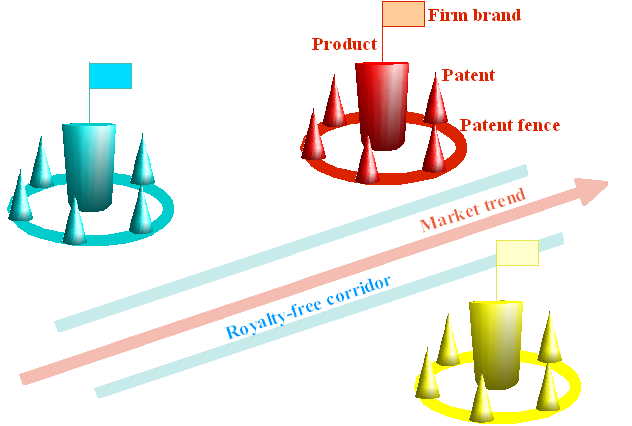

The market tends to follow standards. The reference implementation of the standard and the Open Source implementation sit in a royalty-free corridor around the standard. Commercial products implement the standards and additional functions. These functions are protected by patent fences that prevent competitors of implementing a super set of (1) the standards (2) the functions of the competitor product (3) the functions of the firm product. Large publishers make research and sponsor standards. They can patent in areas where a market could emerge or move like a property developer can buy estate where a new airport, highway or fast railway will be built. Patent fences can overlap. In such case firms seek a settlement or cross license their patents. Therefore the core technology patent space is a desert with high patent density areas in the vicinity of royalty-free corridors.

Patents Presentation Search Issues Strategies Business Methods Patentability Analysis MercExchange eBay Trial Reexamination Business view Granted patents Examination USPTO EPO PanIP Eolas 1-click family 1-click analysis 1-click prior art Trademark Copyright

Contact:support@pagebox.net

©2001-2005 Alexis Grandemange

Last modified